Deduction Pay Cycle Imports

Payroll administrators can now import one-time deduction adjustments from within a pay cycle.

OVERVIEW

Payroll administrators may often need to adjust an existing deduction for one or more employees for a single pay cycle. Previously, if the admin was already processing payroll, adjusting these deductions manually outside of the pay cycle could be time-consuming and require resetting the cycle.

Now, it's easy to import adjustments to deductions for one or multiple employees into a specific pay cycle with Pay Cycle Deduction Imports.

Note on Existing vs New Deductions

Currently, Pay Cycle Deduction Imports will only adjust deductions that are already configured on an employee's payroll record—it will not import new deductions at either the employee or company level.

ACCESS

To begin a pay cycle deduction import:

-

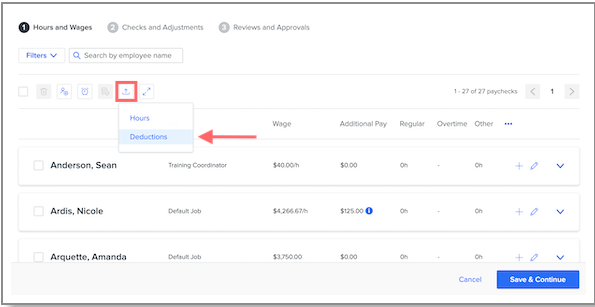

In step 1 of payroll processing, click the Hours and Deductions Import button and select Deductions.

-

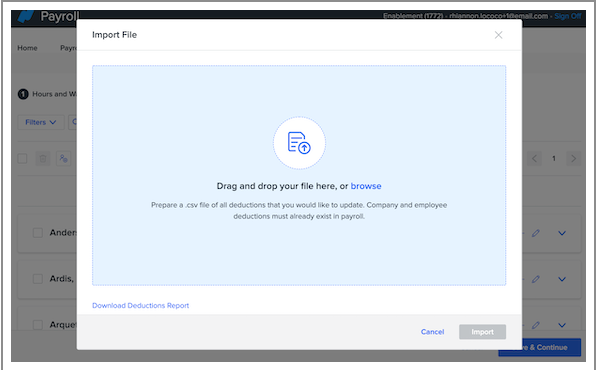

If your deduction import CSV file is ready, you can either drag and drop it into the popup modal or click browse to select the file.

-

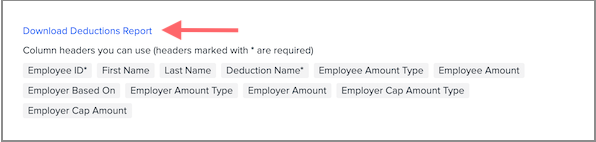

If your deduction import CSV file is not ready, click Download Deductions Report to download a CSV of all the deduction information currently in your pay cycle. Columns include:

-

Employee ID

-

First Name

-

Last Name

-

Deduction Name

-

Employee Amount Type

-

Employee Amount

-

Employer Based On

-

Employer Amount Type

-

Employer Amount

-

Employer Cap Amount Type

-

Employer Cap Amount

-

-

Make any required adjustments to the data in your deduction file. You can delete any unnecessary columns (if desired) except Employee ID and Deduction Name, which are required. Any data you do not adjust will remain unchanged when you import the file.

-

Notes:

-

Garnishment, Tax Levy, and Child Support deduction types cannot be imported and should be edited manually in Step 2.

-

You can import to a deduction that has been suppressed- it will temporarily override the suppression and flow onto an employee's check.

-

-

-

Once you have finished your adjustments, drag and drop the CSV file into the popup modal or click browse to select it.

-

Click Import.

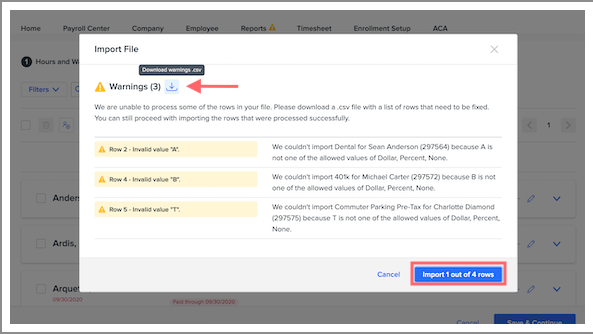

If any errors are found in the import file, you can download a report of the errors, fix them in the CSV, and reimport it. You also have the option to continue the import for any rows that didn't contain errors.

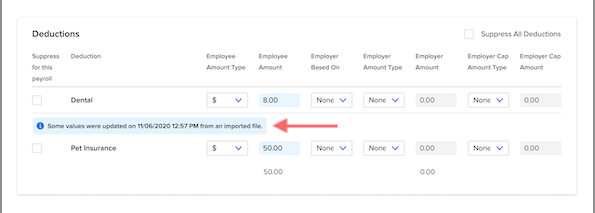

You can confirm that all deduction adjustments were imported successfully in step 2 by clicking on an employee's check. Any adjustments will be noted on the employee's Deductions section, along with the time and date of the adjustment.